HELPING YOUR CLIENTS CREATE THEIR RETIREMENT PLAN IS EASY IF YOU REMEMBER THE 3 C’S

1. CHOOSE

Help your client choose which expenses they can anticipate in their retirement.

Common expenses of course are things like:

Mortgage/housing expenses, Transportation, Taxes, Groceries, Medical bills, etc.

However, it’s important to consider the less common yet very real expenses that retirees will likely want to take into account such as bucket list items like vacations or a dream car, hobbies, parent or elder care, grandchildren care, holiday/birthday gifts, pet care, uninsured losses and more!

Take into account EVERYTHING possible!

2. CATAGORIZE

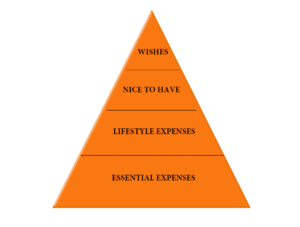

Help your client categorize their needs into a pyramid of needs.

At the bottom of the pyramid – put the essential expenses (mortgage, bills, etc.).

In the lower middle tier – put expenses they could make-do without, but that are important to your retirement lifestyle.

in the upper middle tier – put nice-to-have lifestyle expenses, things they could feel comfortable going without.

In the top tier – have them put their wishes, if they had a windfall, what would they spend it on?!